Gala Bingo (2015- )

Gala Bingo (2015- )

The UK’s premier operator of local gaming and entertainment provision – with over 130 venues across the UK and over 1.4m regular members and players.

Advice and acquisition DD support for the UK’s leading Bingo operator resulting in the successful £241m transaction of Gala Leisure by Caledonia plc.

Provision of advisory and business plan and leadership support. Provision of Chairman and Board support services.

Silentnight Group (2011- )

Silentnight Group (2011- )

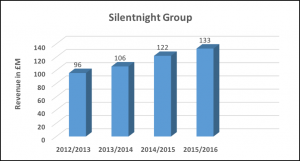

The UK’s leading bed and mattress company and a rare UK Superbrand. Committed to continuous investment and technical innovations into their products.

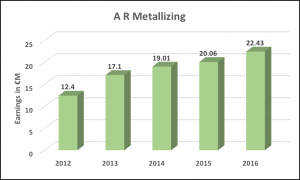

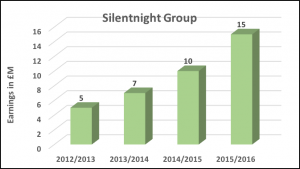

A significant restructure and re-energising of a UK market leading Superbrand in need of repositioning, product quality focus and optimisation. Business performance improvement seeing earnings up over 400% with a business returning to its heyday status. Principal Shareholder – HIG Capital. Advest Capital Management has supported the turnaround programme and the provision of Chairman services to ensure the business is run to the highest standards. Silentnight is now in 2015 also recognised as the sector’s leading apprenticeship provider and the retailer’s category leader in support of the UK sleep sector with licenced extensions across bedding, heaters and sleep solutions/ aids adding to the core bed and mattress range.

Liberis (2013 – )

Liberis (2013 – )

The UK’s leading business Cash Advance provider committed to providing responsible access to funds for the UK SME business market. As one of the most innovative funds providers, repayments are made via a small share of the client’s debit and credit card payments they received being directed to repayment thus ensuring companies where trade is weak pay less and more affordably as a result.

Advest Capital provided the identification, access and advice on the acquisition of the business for leadership and Blenheim Chalcot Investment funds as well as Chairman support and board services.

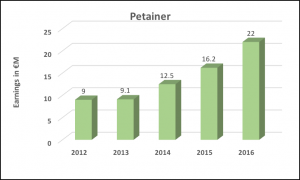

Petainer (2013-2015)

Petainer (2013-2015)

A leading global packaging technology company with proprietary expertise in high stretch polymer engineering, at the forefront of environmental consumer solutions.

An energising and repositioning exercise to enable the investor owners to reveal investment value. The launch of new product into new sectors including Water Coolers in India, Kegs into the USA wine market and food jars in Europe.

Advest Capital provides advisory and investment capital to Next Wave, the majority shareholder, as well as board and Chairman Services in support of the company leadership team and company objectives.

A R Metallizing (2012-2015) – market leading exit

A R Metallizing (2012-2015) – market leading exit

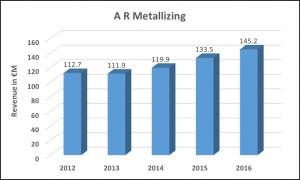

World leader in technological innovation in metallized paper and packaging. Global metallized paper manufacturer; a sustainable alternative to foil or film. Industries include food, beverage, consumer packaging goods and entertainment.

Advest Capital provided Board services and Chairman Services to the company in order that it could deliver a rapid global growth agenda creating the leading global provider across Belgium, Italy, USA & Brazil.

Successful delivery of business plan and sale of the business to Nissha Printing plc as a Tokyo listed stock exchange business. Delivery of superior Equity multiple returns for HIG capital the principal shareholder and the leadership team.

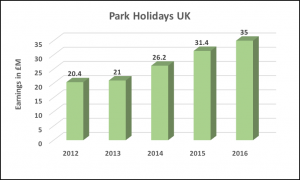

Park Holidays (2012-2013 – market leading transaction & 2013- current)

Park Holidays (2012-2013 – market leading transaction & 2013- current)

The UK’s results leading Caravan and Holiday Park business and the largest provider of Caravan Holiday Parks in the South of England.

Advest Capital provided Chairman & restructure support to Graphite Private Equity in 2013 – to enable an exciting market leading exit for their investment. The sale concluded with Caledonia plc – where Advest Capital then again took on provision of Chairman & advisory services through what has then been a tremendous period of continued performance led growth.

Premium Medical Protection (2011 – 2014)

Premium Medical Protection (2011 – 2014)

Support to establish and develop a scale UK provider of Medical Indemnity Insurance; tailored to specifically suit the needs of individual Consultants Surgeons and their medical specialty. Sector -leading service provision and legal defence support for clients leading to a high quality business -leading company.

Development leading to underwriting in 2015 being taken on by Berkshire Hathaway to provide global leading coverage and run- off capability for clients.

Eurosite Power (2011 – 2014)

Eurosite Power (2011 – 2014)

Energy company providing, financing, installing, owning, operating and maintaining complete cogeneration and cooling systems tailored to customer’s specific site requirements using highly efficient low carbon technologies.

Advest Capital advised the leadership team on the establishment of a sales process and organisational structure through its formative period. With the refinancing of the business and becoming part of USA based DG power, exit of the investor advisory board was achieved.

The Real Pub Company (2008 -2011) market leading investor exit

The Real Pub Company (2008 -2011) market leading investor exit

Establishment of London’s fastest growing and best performing Pub Company with Brockton Capital and management as principal backers. The rapid growth through both repositioning, M&A and the restructuring of a property portfolio swiftly led to super returns and the sale of the business to Greene King plc. The business continued to develop supporting the GK London asset base.

Advest Capital provided organisational advice and support, chairman services and board management and sale process support.

General Healthcare Group & BMI Healthcare (2007 – 2011) market leading performances, minority investor & leadership exit

General Healthcare Group & BMI Healthcare (2007 – 2011) market leading performances, minority investor & leadership exit

The leading provider of independent health care services in the UK. Supporting the £2.4Bn acquisition of GHG with its BMI Healthcare brand through a period of growth 2007-2011. Seeing the business grow from circa £156m EBITDA run rate through £227m at exit ; a successful period seeing the company grow taking on a new facility/ hospital on average every 12 weeks and add to its service line capability.

With Netcare plc of South Africa taking over the company and the strategy, the then exit of minority investors and a new management team taking place. BMI Healthcare was in 2011 the UK’s largest private hospital group and a partner of the NHS and the largest independent sector provider of surgical services under the NHS Choose and Book programme.

Advest Capital Management Company Performance Metrics